Did you know that there are over 600,000 new businesses across the United States each year? However, many of these companies fail within the first few years.

As you might guess, securing proper financing is one of the most important steps to take when it comes to ensuring your company is successful. However, nobody understands the different types of business loans available to them.

Getting a loan can seem complicated, but it’s much more straightforward than many people think. Let’s take a look at the different types of loans that you should consider for your business.

Equipment Loans

As you might guess, equipment loans are used to finance the purchase of new equipment for your business.

This could be anything from office furniture to a fleet of vehicles. The great thing about equipment loans is that they can be used for both brand-new and secondhand items. The main advantage of an equipment loan is that the equipment itself acts as collateral for the loan.

This means that even if your business isn’t doing well, the lender will still be able to get their money back by selling the equipment. Another advantage of equipment loans is that they can often be structured so that you don’t have to make any repayments for the first few months.

This can be a great way to free up some cash flow in the early days of your business.

Online Loans

You don’t always have to visit a financial institution to take out a loan.

These days, many lenders offer online loans that can be applied for and approved entirely online. Taking out a loan online is the most convenient way to do so. You can apply for them at any time of day or night, and you’ll usually get a decision within minutes.

Another advantage is that you’ll often be able to get a lower interest rate on an online loan than you would if you went to a bank. The only downside of taking out a loan online is that you’ll usually have to provide some form of collateral. This could be in the form of an asset such as your home or car.

If your credit is high enough, however, you may be able to circumvent this obligation.

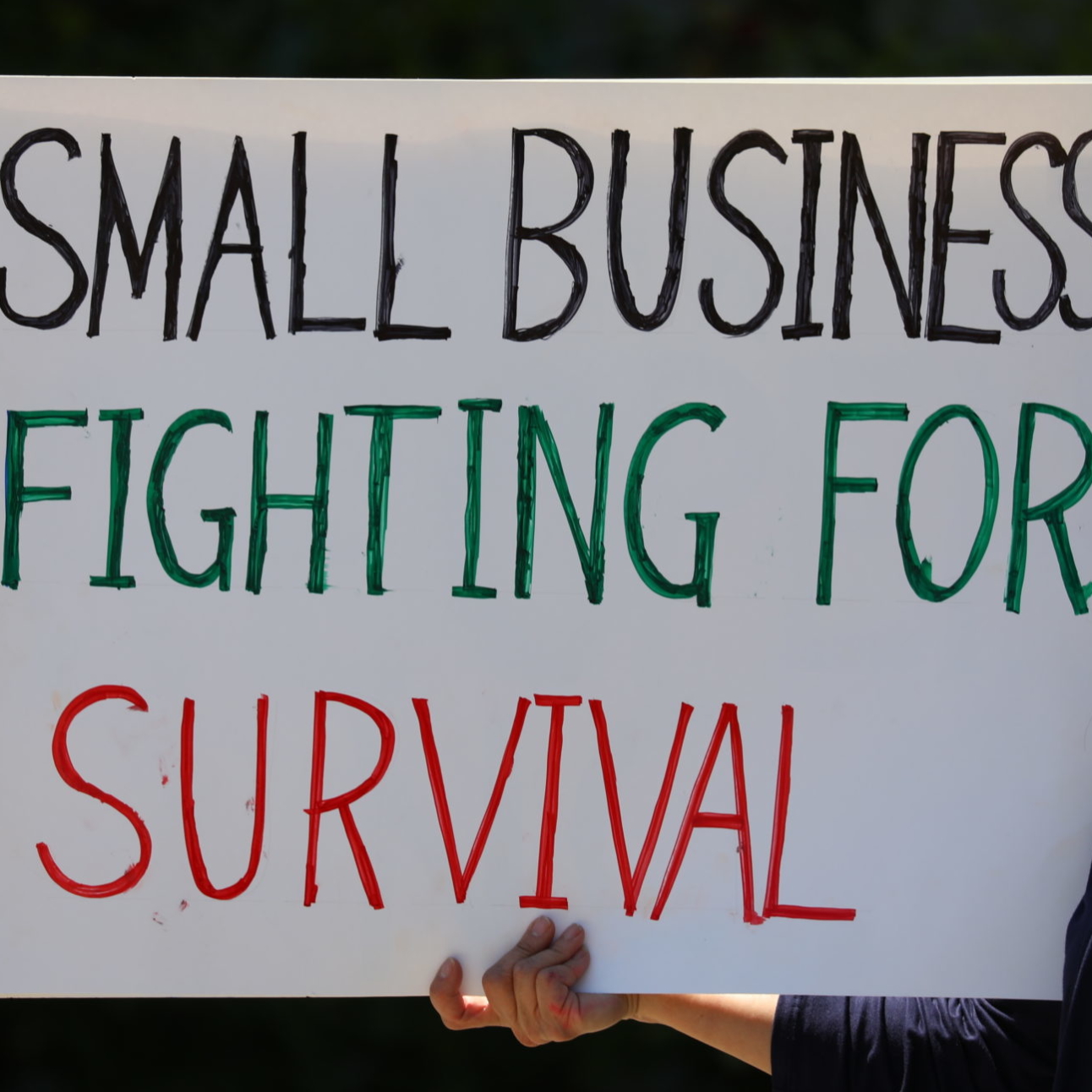

Small Business Loans

As the name suggests, small business loans are designed specifically for small businesses. They tend to have a lower interest rate than other types of loans and are often easier to qualify for.

Small business loans can be used for pretty much anything. Whether you’re looking to finance a new venture or just need some working capital, a small business loan could be the perfect solution.

No Credit Check Loans

A credit score is often the biggest obstacle business owners face when they are looking to take out a business loan.

However, there are now lenders out there who offer “no credit check” loans. As the name suggests, these types of loans don’t require a credit check.

This means that even if your score is low, you’ll still be able to get the financing you need. The disadvantage of no credit check loans is that they often come with a higher interest rate.

However, having access to the cash you need with few barriers is invaluable. Keep this in mind if you are looking for fast loans Canada.

Invoice Financing

If you’re a business that relies on invoices to get paid, then invoice financing could be the perfect solution for you.

With this type of loan, you can use your outstanding invoices as collateral. This means that even if your customers are slow to pay, you’ll still be able to get the cash you need.

There are two types of invoice financing: invoice factoring and invoice discounting.

With invoice factoring, you sell your invoices to a lender at a discounted rate. With invoice discounting, the lender gives you a loan that is based on the value of your outstanding invoices.

Invoice factoring is generally easier to qualify for but can be more expensive in the long run. Invoice discounting, on the other hand, is usually a cheaper option but can be harder to qualify for.

Traditional Bank Loans

A bank loan is often one of the first places people think of when they need financing.

And while they can be a great option, they’re not always easy to qualify for. However, bank loans often require a lot of paperwork.

This can be time-consuming and frustrating, especially if you’re already busy running your business. Another downside of bank loans is that they often come with a higher interest rate. This is because banks are considered to be low-risk lenders.

If you have good credit, though, you may be able to negotiate a lower rate.

How King Cash Can Help

We are proud to offer a variety of fast loans to those in need. Our goal is to ensure that business owners have access to the capital they need to ensure they stay afloat.

The application process at Kingcash is also notably simple. You can check out www.kingcash.ca to learn more.

Understanding the Different Types of Business Loans Is Easier Than It Seems

Although taking out a business loan might seem daunting, it’s not nearly as complex as most people believe. Just make sure you understand the different types of business loans so you can choose the one that is best for your situation.

Want to learn more about what we can do? Be sure to reach out to us today and see how we can help you.